In Short

Advice

The MRR (Minimum Retail Rate) is a floating interest rate charged by commercial banks to premium retail customers, such as a personal loan or home loan, it is often used for personal loans and fixed rate home loans. This is an interest rate that is rising every month. In addition, the MRR interest rate is charged by new customers.

The MRR is classified as a floating rate, which means that the interest rate will vary according to the cost of the financial institution, which is informed by the financial institution in cycle.

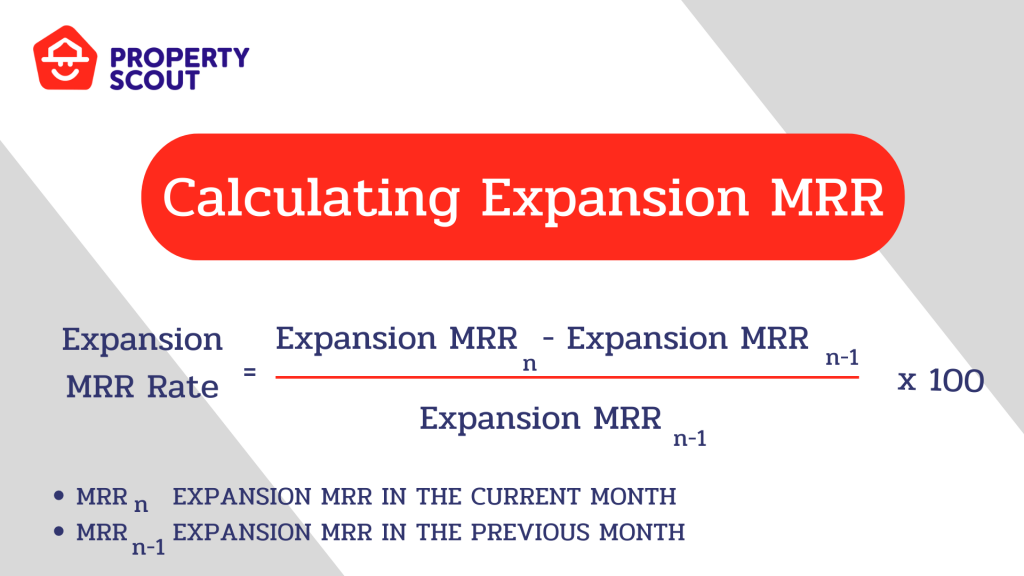

How to Calculate Expansion MRR Rate?

The interest loan is expressed as a percentage or percentages per year. By calculating the loan principal, i.e. interest at 6% per year, both parties enter into a contract with a repayment period of 10 years, during which the creditor must repay 6% until the contract expires.

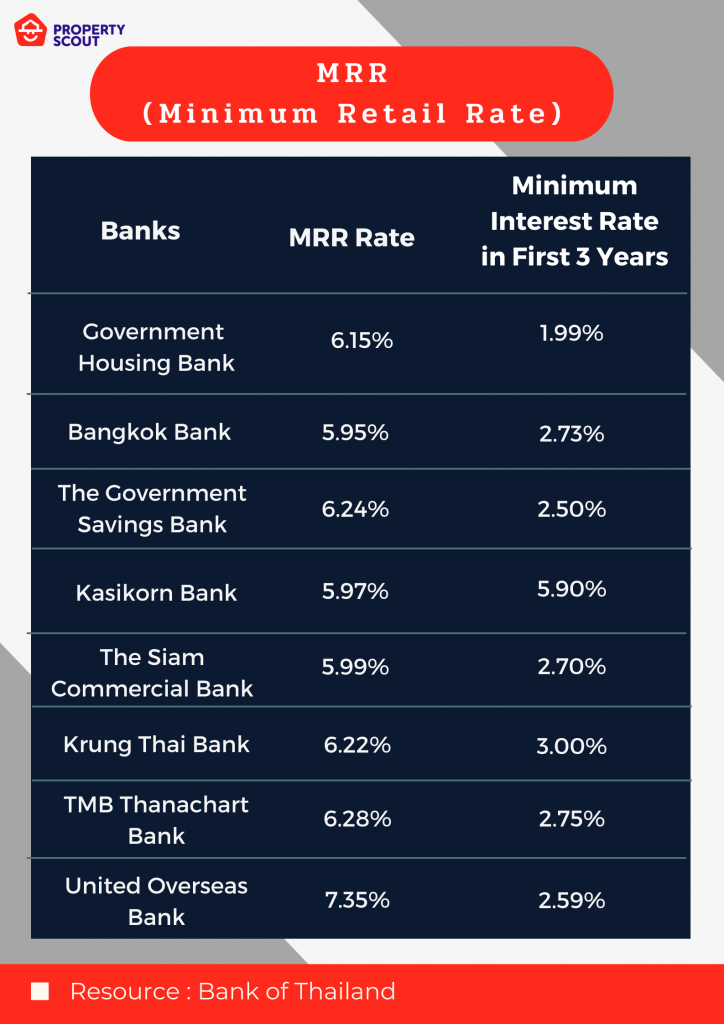

MRR (Minimum Retail Rate) of Thailand Commercial Banks in June 2022

Comparison table for each type of Interest Rate

FAQs

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Explore More Topics

Free real estate resources and tips on how to capitalise