In Short

Advice

In this modern era of urban living, both condominiums and houses are overseen by legal entities to ensure shared properties remain in optimal condition and operational. To uphold the collective advantages enjoyed by all owners, there are costs linked to the maintenance of these shared assets. These encompass security fees, water and electricity charges, the upkeeping of common areas, tending to gardens, access to clubhouses, use of pool facilities, waste management, administrative fees, and all indispensable costs tied to communal spaces.

Every resident bears the responsibility of contributing to these expenditures monthly, often assessed annually based on the proportions of their individual living spaces. Shifting our focus to the term 'debt-free certificate,' it's conceivable that many individuals might not yet be acquainted with this concept or grasp its significance. What precisely is a debt-free certificate? What sort of information does it encompass? Let's embark on an exploration to uncover the core of this document, as it bears immense relevance for both property vendors and purchasers within the realm of residential real estate.

What is a Debt-Free Certificate? Are they necessary for house and condo sales?

A Debt-Free Certificate is a paper that states the fees for shared common spaces where we live in condos or housing communities. If you don't have this paper, you can't switch property ownership at the Land Department. In simpler words, it's important when you want to change property ownership.

For houses in communities without a legal group and no shared costs, this paper might not be needed. But people buying or selling homes should check before they go to the Land Department, so they don't waste time on ownership appointments. But remember, for all condo projects, you always need a Debt-Free Certificate.

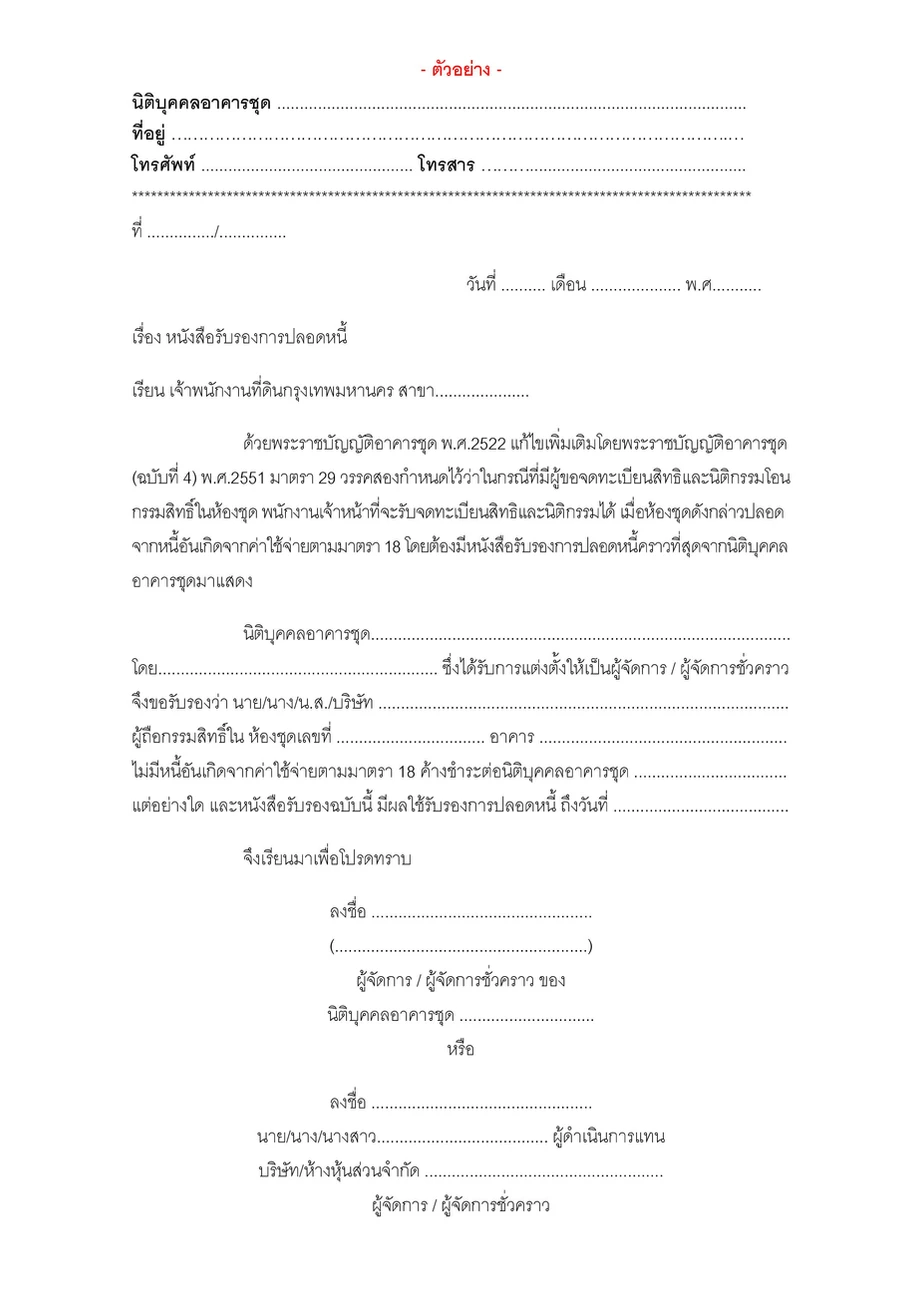

Debt-Free Certificate Example

Who should request for a debt-free certificate?

The seller must request for a debt-free certificate document at the juristic office to pay for relevant fees. The seller can have someone else request for the certificate in their place, but they will need a power of attorney letter and a copy of their ID card.

Required Documents in requesting for a Debt-Free Certificate

- Seller and buyer's copy of house registration booklet.

- Seller and buyer's copy of ID card.

- Copy of title deed (front and back).

- Sales contract.

- Proof of name/surname change (if applicable).

- Power of Attorney document (in case of not requesting personally).

- Authorized person's copy of ID card (in case of not requesting personally).

How long does it take to request for a Debt-Free Certificate?

After the request, the juristic office will take 7-15 business days to process (depends on juristic office's regulations). Sellers need to be aware of these timelines and plan ahead.

The debt-free certificate is important for transactions and is valid for no less than 7-15 days (depends on juristic office's regulations) from the date on the document. Without this document, property rights transfer cannot proceed at the Land Department.

What makes a Debt-Free Certificate Important?

It's important to know that if someone doesn't pay their common area fees, there will be fines set by the condominium committee. This means there are cases where people might avoid paying. Without rules in place, even if they announce they'll charge interest, those who don't want to pay might still not do so. Each housing project might find ways to manage this, like not allowing parking stickers or access for these individuals, but these measures can be tough to enforce.

That's why the debt-free certificate is important, as it reminds everyone of their duty to pay these fees. If you neglect these payments, it can make selling our property difficult. In the worst case, you might not be able to transfer ownership.

Additionally, if you keep missing these fees, besides facing extra charges, it could result in legal trouble. When you want to sell, the juristic office might refuse to issue a debt-free certificate, and Land Department officials can prevent property transfer due to these unpaid fees.

Fines and penalties for missing common area fees

Condos

- 12-20% fine plus interest rate.

- No voting rights in meetings.

- Inability to transfer ownership.

- Subject to legal action for debt collection.

Houses

- 10-15% fine plus interest rate.

- Possibly revoked of common area and shared facility access.

- May face restrictions on property rights registration or transactions related to the project, including sales.

- May be sued for debt collection.

Stay Informed!

If you're thinking about buying a used home, it's important to have a look at the debt-free certificate. This paper helps you check if the home's owner paid all their bills and debts. If you already paid or reserved the home, you need to make sure you can get the home without any problems because of unpaid bills. If you don't check this, things could get complicated. So, it's a smart idea to look into everything well before you decide to buy a home.

Interested in buying beautiful homes or condos with PropertyScout, complete with debt-free certificates? Click the links below and put your worries to rest!

FAQs

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Explore More Topics

Free real estate resources and tips on how to capitalise