What is Floating Rate?

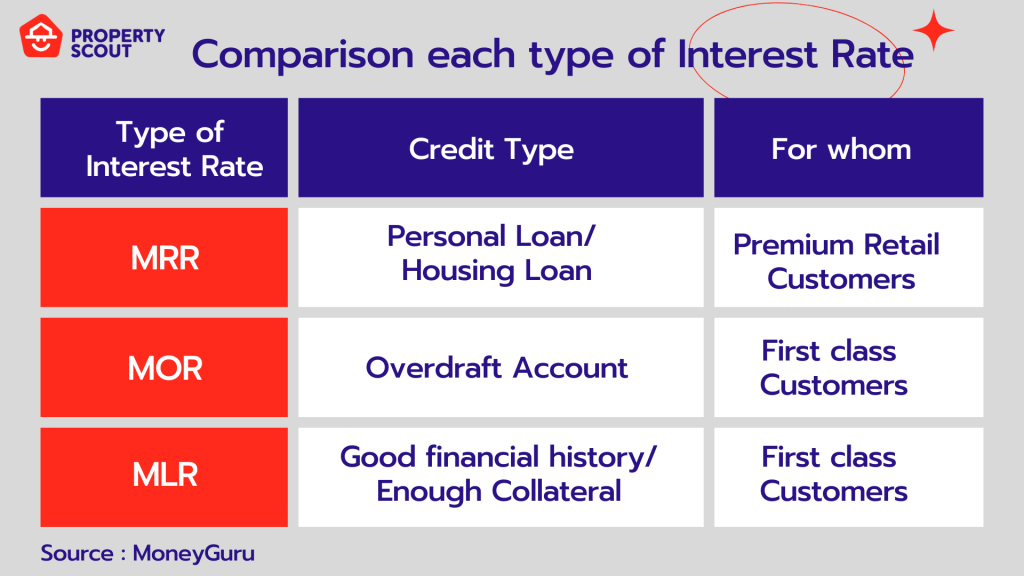

The Floating Rate is interest rate on a loan that varies according to the cost of the financial institution. The interest rate is adjusted according to the economy, according to what financial institutions occasionally announce, such as the reference rate of various commercial banks. Financial institutions charge three types of interest rates to their customers : MOR MRR MLR

MRR (Minimum Retail Rate)

This is the variable interest rate charged by commercial banks to premium retail customers, such as personal loans and housing loan. It is frequently used for personal loans and installment loans. This is a monthly interest rate that rises ; additionally, new customers are charged the MRR interest rate.

MOR (Minimum Overdraft Rate)

MOR (Minimum Overdraft Rate) paid by commercial banks from major customers with a good financial history and overdrafts account.Therefore, banks need to increase their lending considerations.

MLR (Minimum Retail Rate)

The MLR (Minimum Loan Rate) charged by commercial banks come from first-class customers, such as those with a good financial history. There are enough guarantees. Most of them concern long-term fixed-term loans, such as corporate loans.

Comparison table each type of Interest Rate

Read more for the Article relate to Fixed Rate , MRR , MOR , MLR