In Short

Advice

FAQs

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Explore More Topics

Free real estate resources and tips on how to capitalise

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise

How much exactly is "JUST RIGHT"?

You all have probably ran into countless problems, often asking yourselves, "WHICH TYPE OF ROOM SHOULD I BUY?" or "WHAT KIND OF ROOM WOULD BE SUITABLE FOR ME?". Join us today as we give you a look at the various types of rooms to choose from!

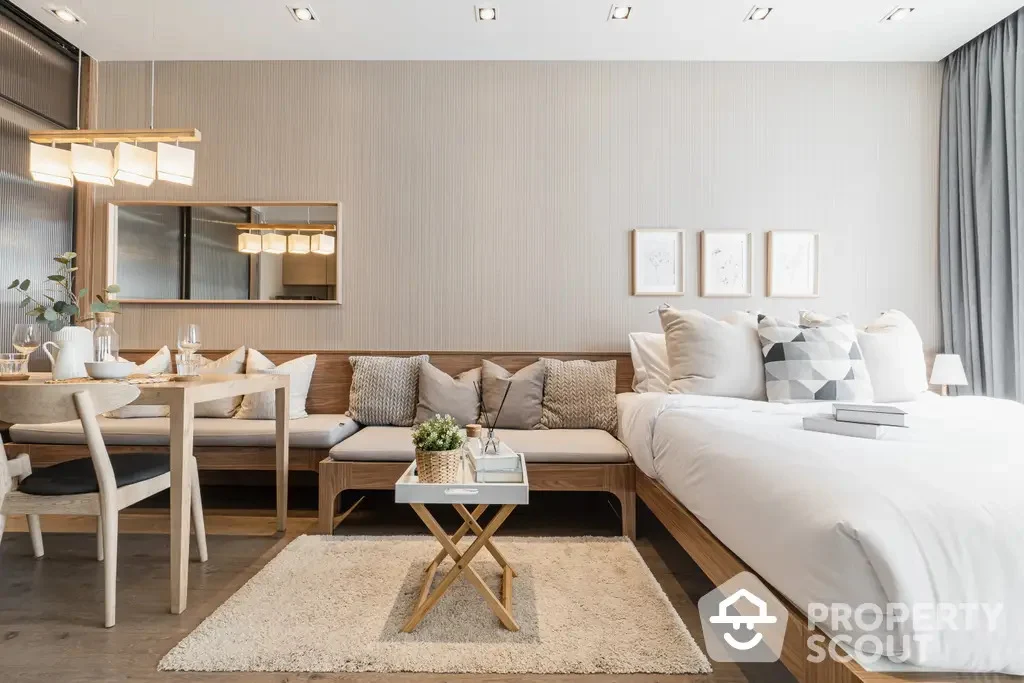

A studio room is typically 20 to 28 square meters. Most of the time, the zones of the room aren't clearly separated from each other, to which the bedroom and living room are combined. As for the kitchen, some are separated by a wall, while some are just a blank area in which a slide door can be installed as well.

Best for: Lone tenants who only need a simple condo to back to after work.

Price: Best for those whose budget isn't very high, coming at approximately 1-2M THB, no more than 3M THB, the standard price for studio rooms.

Not suitable for: Cooks or those who just like spacious areas, due to lack of space.

Interested in a nice studio room? Click here!

This type of room, as the name suggests, includes one bedroom in addition to one bathroom, kitchen, and a living area, all of which measures 30 to 64 square meters. Zones in this room are clearly separated, particularly the bedroom from the living room. However, the rest depends on the condo design itself as to whether or not the kitchen and living room would be separated from each other or will we have to renovate them ourselves afterwards.

Best for: 1-2 tenants, particularly couples, since this type of room is considerably larger and more spacious than the studio rooms. Most importantly, this type of room is perfect for cooks, as one does not have to concern themselves with smell issues.

Price: Best for those who have a mid-to-high budget, since the 1-bedroom type of room varies depending on the overall size of the room in square meters. For instance, if one is interested in a 30 square meter room, that would be approximately 2-5M THB.

Not suitable for: Those who estimate prices that aren't too high, particularly families.

Interested in a 1-bedroom? Click here!

While similar in size as a standard 1 bedroom, coming in starting at 32 square meters, what a 1 bedroom plus brings to the table is one additional medium-sized empty room, the multipurpose room. Depending on the tenant, it can be anything from an additional bedroom to a personal office, a fitness area, or a room for kids.

Best For: 1-2 tenants, especially families who are recently married or are expecting a child.

Price: Best for those who have a mid-to-high budget, much like the standard 1 Bedroom, with the price range being relatively close and varying depending on the overall room size in square meters.

Not suitable for: Lone tenants who may desire a smaller, more compact room.

There are 2 bedrooms within this type of room, coming in at 40 to 100 square meters. However, the rooms themselves come in at varying sizes, some having a master bedroom and a smaller bedrooms, while in some cases both bedrooms are relatively large, with some even including one or two bathrooms. If there are two bathrooms, one will be within the main bedroom and the other would be outside.

Best for: Parents with one child, or for staying with friends, as clear room separation greatly provides privacy.

Price: A 2 Bedroom's starting price is 3M THB and above. Keep in mind that prices will vary depending on various factors such as width, overall square meters size, and location

Interested in a 2 Bedroom?

A Duplex is another name for a two-story condo, as we've been accustomed to calling. The room is over 4 meters in height, making it suitable for people who want a nice, big, comfortable room comparable to that of a house. As for the second floor, it is a free-to-decorate multipurpose room, which typically become a bedroom or an additional living room.

There will be two separated bedrooms, depending on the design of the condo development itself.

Best for: Those who want a house-like vibe, thanks to its height and spaciousness, as well as those who want the bedroom separated from other areas of the room.

Price: Starting price for a duplex room is 5M and above, depending on the size of the room and the location.

Not suitable for: People who don't like heights or those who feel as if privacy is lacking.

Interested in a Duplex room? Click here!

Finally, the room that everyone says is nice and spacious, as close to a house as one could possibly get, so luxurious, that can be none other than a penthouse, which is the rarest in any condo development due to its luxurious exclusivity, coming in over 100 square meters in size.

Usually, a penthouse is located closer to the very top of the condo development, due to it requiring a huge amount of space and privacy. Bedrooms are separated into at least three bedrooms, and accommodations are more than enough. However, additional decorations are limited only to the tenants' desires.

Best for: Those who want privacy and a spacious area, as well as those who prefer staying inside the room more than outside, or those who are inviting friends and families to stay in this luxurious environment.

Price: A penthouse is a huge leap in the way of price, coming in significantly higher than most rooms at 25M THB and above.

Not suitable for: Those on a budget and not asking too much out of their stay in the way of additional accommodations or decorations.

Interested in a penthouse? Click here!

| Tenants | Width | Price | |

| Studio | 1 person | 20-28 sqm | 1-2M THB |

| 1-Bedroom | 1-2 people | 30-64 sqm | 2-5M THB |

| 1-Bedroom Plus | 1-3 people | 32-64 sqm | 2-5M THB |

| 2-Bedroom | 2-3 people | 40-100 sqm | 3M THB |

| Duplex | 1-3 people | 30 sqm and up | 4-5M THB and up |

| Penthouse | 1 person and up | 100 sqm and up | 25M THB and up |

In conclusion, each type of room varies in terms of room size, square meters, price, and suitability in staying in which one can easily pick their desired room with the information provided. We just want to say choosing our desired condo size is crucial as that would be your place of residence for the foreseeable future, or you can even list it out for rent or sale as well.

We hope this article helped you in your decision making, and if you would like to learn more, please get in touch with us, we can't wait to see you again in our next blog post.

If you have any questions or further inquiries regarding buying, selling, renting real estate properties, or you're looking for a residential place of your desire at a reasonable price, and making sure you get what you paid for, feel free to contact PropertyScout, our team will be happy to help answer your questions.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise

Ladprao - Neighborhood of a dream as a hub of transportation

Ladprao is jokingly known as one of the worst traffic jams in Bangkok city. But with a lot of options of public transportation these days, Ladprao is becoming a popular area to live. There are so many reasons why we should make Ladprao a home which is accessible to both BTS and MRT, dining spots, and fun landmarks all around!

Let us guide you to one of the most popular districts in northern Bangkok, Ladprao has been growing over the past years. From a very well known area of shopping complex such as Central Plaza Ladprao and Union Mall being a big name there to a living neighborhood everyone wants to live.

With the easy accessibility of BTS and MRT lines, residential projects have been established for over the last couple years. And to avoid heavy traffic during rush hour on Ladprao main road, there is no denial that condominiums in this neighborhood are only getting busier.

You can reach Ladprao area by both BTS and MRT station. The BTS skytrain station of Ha Yaek Ladprao is definitely the main one and just a few mins away is MRT Phaholyothin station. The BTS station goes along the Sukhumvit line directly. It is not only super convenient to travel outside of Bangkok to upper northern stations that stop at Kukot station, but also easy to commute to the city center as well.

You can access the Ladprao neighborhood via Ladprao road that is connected to many main roads of northern Bangkok. Starting from Ladprao intersection, which is the intersection between Phaholyothin road and Vibhavadi Rangsit roads. Towards the southeast side is an intersection with Ratchadaphisek Road passing through Chokchai 4 and Pradit Manutham road.

The extension of the BTS Green Line from Mo Chit to Khu Khot station caused the private sector a lot of investment in Ladprao neighborhood, with the prediction that this district has the opportunity to become a new business center or New CBD (New Central Business District) of Bangkok city. One of the reasons is that the intersection station connecting BTS and MRT immerses people from the Vibhavadi Rangsit side and Chatuchak area towards the city center. In the future, we are likely to see a lot of mix-used building property projects and residential condominiums.

With the area getting more and more popular everyday due to the extension of BTS Green Line, the price at Ladprao is now starting between 215,000-250,000 baht/sqm. (as of October 16, 2022). And there is a possibility that it will rise in the near future with more high-rise and upscale residential projects currently in development.

The rental price in Ladprao area is a vast majority. It could range from 8,000 baht/month and above, since you will find many types of accommodations from apartment, mid-scale building, low-rise to luxury high-rise condo.

An ideal condominium for the adaptive generation with a prime location close to both BTS Ha Yaek Ladprao and MRT Phaholyothin, Life @ Ladprao is literally perfect for those who love convenience. The highlight of this project is green urban space with over 3,200 square meters.

The selling price is starting at THB 3,890,000

Looking to rent at Life @ Ladprao? click here

Looking to buy Life @ Ladprao? click here

Designed under the concept of urban and cubism, M Ladprao offers you a comprehensive variety of on-site facilities. M Ladprao is a high-rise condominium with a total of 43 floors and a roof, which comes with a prime location as 5 minutes from MRT Phaholyothin and only 1 minute from Central Plaza Ladprao shopping mall.

The selling price is starting at THB 6,200,000

Looking to rent at M Ladprao? click here

Looking to buy M Ladprao? click here

A low-rise condominium with a total of 8 floors and 163 units, The Origin Ladprao 15 offers the perfect balance for those seeking privacy and convenience as it’s only 600 meters away from MRT Ladprao.

The selling price is starting at THB 3,290,000

Looking to rent at The Origin Ladprao 15? click here

Looking to buy The Origin Ladparo 15? click here

Needless to say, if anyone is looking for a convenient area of public transportation to stay, Ladprao is definitely the one. Being a hub of both BTS and MRT station and on top with the intersection of main major roads of northern Bangkok, no one does it like this neighborhood.

Looking for a property to buy or rent in Ladprao? Let PropertyScout help you!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise

Nana Neighborhood where boredom could never be found

If you ask one to name one of the very most popular nightlife spots in Bangkok, Nana definitely makes it to the top list. But not only for the growing market of clubs and bars along the area, Nana neighborhood is also a perfect combination of living neighborhood, cool hangout and party spot, and shopping malls with lots of things hustling only from just a walking distance.

There is no denial that Nana is a hub for Bangkok's nightlife with tons of high-end clubs and rooftop bars along the area. Furthermore, Nana is also a destination for middle eastern travelers. You will notice many Arabs and Middle Eastern communities as a majority of the northern Sukhumvit area. As most shops label with Arabic, English and Thai.

A mixture of multiple nationalities and regions in Nana leads to many condominium and hotel residential projects. You can walk almost everywhere from BTS Nana station to shopping malls and even to office buildings.

Best party street in Bangkok, you must say. At Sukhumvit Soi 11, you will find hundreds of bars along the street with many many styles from sport bars to hip hop nightclubs. You named it, Soi 11 has everything to cover your needs. The street could last all night long, making this the area that never sleeps.

Skytrain station with the same name, BTS Nana is a stop for this neighborhood. The area goes along the BTS Sukhumvit line from the northern part of Sukhumvit until the very end at Asoke station. As mentioned that Nana offers convenient walking distances with everything in between, you can just take a stop to this station and walk to everywhere you need. And within a few walks or one BTS station away, you will find BTS Asoke station which is an easy connection to MRT lines of Sukhumvit station.

Nana area goes along with Sukhumvit road which sometimes faces heavy traffic during rush hours. We recommended taking BTS to avoid this busy road. However, traveling within Nana by car takes you to a lot of shortcuts here. Nana area starts from Soi Sukhumvit 3 which is an access shortcut to New Petchburi road in Makkasan district. Then on Soi Sukhumvit 4 toward the Thailand Tobacco Monopoly leads you to Ploenchit Intersection on Ploenchit Road.

Being a top destination for middle eastern travelers when visiting Thailand, in the future we are going to see more and more hotel projects, especially the high-scale one in this area, as these groups of travelers always stay in chain hotels rather than just a standalone one. Considering this area is a great opportunity for investment as well, if anyone is looking to own a property in this neighborhood, this is your chance to make more money in the long term.

We might actually spot more hotels than residential or condominium projects in the Nana neighborhood. Hotels in the area range from ultra luxury, mid-scale to even hostel. That explains how popular the neighborhood is for travelers who want to experience Bangkok’s nightlife and Arabian communities. The rise of the hotel is one reason why the cost of this area is rising each year. The price is between 210,000-650,000 baht/sqm. (as of October 13th, 2022) and continuing with expectation of hotel projects.

The rental price is starting from 10,000 baht/month for a condominium. However, it might be a little rare to find any rentals available under that price, since the area is pretty much surrounded by many high-end hotels which makes it difficult to find a lower price for any kind of accommodation. But you can be sure to have a property with such a perfect location.

A high-rise condominium with only 350 meters from BTS Nana station and just a few minutes away from Ploenchit neighborhood, this is a mixed-use property project with residential area on the top floor and space for offices underneath. The property itself also offers a ‘Service Residence’ that comes with 24 hour reception, 24 hour security, laundry service, room service, daily housekeeping, and maintenance on-call.

The selling price is starting at THB 6,800,000

Looking to rent at The Rich Nana? click here

Looking to buy The Rich Nana? click here

Located on Soi Sukhumvit 11, it is considered a center of Nana neighborhood and only 450 meters from BTS station. You can walk from Hyde Sukhumvit 11 to everywhere nearby such as shopping malls, restaurants, and bars. Offering various bedroom types starting from a bedroom studio to top-floor penthouse.

The selling price is starting at THB 5,900,000

Looking to rent at Hyde Sukhumvit 11? click here

Looking to buy Hyde Sukhumvit 11? click here

Another high-rise condominium with the specialty of the location, Q1 Sukhumvit Condo by Q House is almost exactly next to the BTS, even having direct access from the station. This residence definitely has a prime location in the area. 40-story height and offers various room types starting from 2 bed-rooms to a penthouse.

The selling price is starting at THB 30,000,000

Looking to rent at Q1 Sukhumvit Condo by Q House? click here

Looking to buy Q1 Sukhumvit Condo by Q House? click here

Overall, Nana neighborhood is definitely an ideal area to stay if you’re looking for a perfect walking distance location. You will find everything you need within just one BTS station and nearby, and it would be a dream of nightlife lovers to be close to the party scene at such a top location of Bangkok. The area itself is hustling both day and night, guaranteeing you would never get bored.

Looking for a property to buy or rent in Nana? Let PropertyScout help you!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise

Trendy local living with an accessible to everywhere

Located north of Bangkok upper from the center district, Phaya Thai neighborhood is one of the local homey areas to explore with plenty options of affordable food, commercial building on top with easy access of both BTS Phaya Thai and Airport Rail Link lines. You can travel anywhere in Bangkok just in time.

This neighborhood was named after the Phaya Thai palace, which took place in Bangkok city since the early nineteenth century. With a long history itself, this district is home to many government offices such as Royal Thai Army, Ministry of Finance, Government Saving Banks and many more, later being occupied with various commercial buildings and offices. Needless to say, Phaya Thai has become one of the growing neighborhoods to live in with a wide variety of affordable stuff going on.

BTS Skytrain station with the same name, BTS Phayathai, and just a few stops away from city center of Bangkok at Siam station. And also not too far from a transportation hub in northern Bangkok of Mochit neighborhood, Phaya Thai can be reached easily via BTS station along Sukhumvit lines. Another convenient way to travel is definitely an Airport Rail Link station. At Phaya Thai station, you will find the BTS connected to ARL station as being the first stop of the airport lines can take you to the airport directly in 40 minutes.

Phaya Thai area is combined with two sub-districts, which are Phaya Thai and Samsen Nai. The neighborhood is located with such a perfect location that it can be traveled by car all the way through. The main road to commute is Phaya Thai road. Starting up north, Phaya Thai can be accessed through Chatuchak district. Moving on to the east side connected to Din Daeng district with a connection with Vibhavadi Rangsit road. The opposite side to the west is Dusit district. And lastly to the south side is Ratchathewi, to the inner part of Bangkok.

One of the big upcoming projects in Phaya Thai is the ‘One Phaya Thai’, the one and only mixed use property project in Phaya Thai neighborhood, and scheduled to be opened by late 2023. One Phaya Thai is a perfect combination of luxury hotels, retail stores, and office spaces aiming to be an all-inclusive destination for both travelers and locals to find everything they need at just one place.

Phaya Thai is getting busier day by day with rental properties projects, it is considered one of the most crowded areas to live. Since the neighborhood offers such an affordable price of living and is not too far away from Bangkok inner center at all, the price on the market is now starting at 400,000 baht/sqm. (as of October 14, 2022).

The rental price could be starting from 8,000 baht/month, depending on the type of accommodation. You will find a wide variety of rental projects from just an apartment to high-rise condominiums, but all guaranteed with a good price compared to other neighborhoods.

Only 8 minutes from BTS Phaya Thai station and 1 minute from the motorway, The Address Phaya Thai is a high-rise condominium with a total of 32 floors. This residence is surrounded by many convenient stores such as shopping malls, supermarkets, restaurants, cafes, and coffee shops, it takes only a 7-minute walk to the nearest hospital.

The selling price is starting at THB 5,590,000

Looking to rent at The Address Phaya Thai? click here

Looking to buy The Address Phaya Thai? click here

Another high-rise condominium in the area of 38 floors in total, The Room Phaya Thai is the luxury class segment of condominium. The location itself is close to both BTS and ARL station. The condominium offers a lobby lounge, meeting room, co-working space, mini theater, and social lounge. The highlight is the rooftop pool on the 37th floor with a panoramic Bangkok view.

The selling price is starting at THB 5,490,000

Looking to rent at The Room Phaya Thai? click here

Looking to buy The Room Phaya Thai? click here

Another luxury class condominium in the neighborhood, M Phaya Thai, is only 450 meters away from BTS Phaya Thai station and 270 meters from BTS Victory monument, super convenient to take BTS from both ways. This high-rise condominium offers a total of 35 floors and was built under the idea of a green project. That being said, this residence aims to offer sustainable living for every resident.

The selling price is starting at THB 16,000,000

Looking to rent at M Phaya Thai? click here

Looking to buy M Phaya Thai? click here

There are many reasons not to miss visiting Phaya Thai neighborhood, and even plenty more reasons to make this area your home. Phaya Thai neighborhood has a mixed variety of lifestyle from urban city life, since it is close to public transportation to a local life experience, and affordable food vendors. You will be sure to get the best of both worlds.

Looking for a property to buy or rent in Phaya Thai? Let PropertyScout help you!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise

PropertyScout, a PropTech startup based out of Thailand, recently announced that it has closed its US$ 5 million Series A financing led by Altara Ventures, bringing total funding to US$ 7.8 million. The round has been joined by Partech and many returning investors, among them are Hustle Fund, AngelCentral, Asymmetry VC, and Dr. Carsten Rahlfs (Partner, Waterland Private Equity).

The funds will allow PropertyScout to scale its core business model in its first market, Thailand, by doubling down on investments into its technology platform, creating the largest, most updated and accurate property database available to its customers and co-broker partners, growing domestically organically and through acquisitions, and preparing entry into additional markets in Southeast Asia. The 200-staff company will continue to hire across product and software engineering, sales, property management, marketing, and operations.

Founded in 2020 by Mario Peng (CEO), Dr. Marco Barth (COO) and Salita Kamnerdsiri (CSO), PropertyScout, a Thailand based Proptech start up, is an end-to-end real estate transaction platform connecting over 1,800 agents and agencies with buyers, renters and owners, servicing thousands of satisfied customers every month. PropertyScout leverages its database of more than 200,000 properties, its technology platform and its centralized operations to digitize and automate 90% of the real estate transaction. This frees up agents’ time to professionally and efficiently communicate with buyers, renters, owners and co-agents to deliver outstanding service and close transactions faster. Providing a transparent and trusted experience, PropertyScout has quickly become the favorite go-to-place for buying, selling, and renting real-estate in Thailand, as proven by hundreds of five-star reviews.

“The real-estate market in Thailand and many other markets in Southeast Asia is fragmented and plagued by fake and outdated listings. PropertyScout has successfully built a technology platform and scalable processes to solve this problem. After becoming the largest agency and co-broker platform in Bangkok, we now take the next step to serve all customers and agencies in Thailand through our platform. Customers and agents alike benefit from our technology and streamlined processes, closing deals faster and more reliably than ever before. We want to help everyone to buy, sell or rent a home in an easy and trusted way - first in Thailand and then across Southeast Asia.” said Mario Peng (Founder and CEO, PropertyScout).

Tan Chow Boon, General Partner of Altara Ventures commented: “The outstanding founding team of PropertyScout, consisting of Lita, Marco and Mario, are dedicated to one mission: Making real estate transactions easy, trusted and transparent across Thailand and Southeast Asia. The founders together with their experienced team have grown the company 7-fold over the past year. We are excited to now join and support them on their journey to transform real estate across Thailand and Southeast Asia.”

###

About PropertyScout

PropertyScout is the leading Thailand-based end-to-end real-estate transaction platform offering one of the largest selections of residential properties for rent and sale.

Founded in 2020 by a team of experienced entrepreneurs and industry experts, PropertyScout’s tremendous growth is driven by a seasoned sales team, data-driven marketing and proprietary technology.

About Altara Ventures

Altara Ventures is a Singapore based VC fund investing in early-stage tech startups across Southeast Asia. The USD 130m fund is led by Koh Boon Hwee, former chairman of Singapore Airlines, DBS Group, and Singapore Telecommunications.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise

New homey-nieghborhood with such an affordable price

Ratchayothin is a familiar neighborhood of northern Bangkok. When mentioned about this area, most people must think of big named shopping malls as Central Plaza LadPrao or Major Cineplex Ratchayothin. Time passed by with the extension of BTS Sukhumvit lines, Ratchayothin now has the station of its own as Ratchayothin BTS station which is definitely going to attract more people to the neighborhood.

Ratchayothin was well known in the past as a local area for a living with only two major shopping malls in the area and still no connection of skytrain or subway line. Besides Central Plaza LadPrao being a main attraction of this district, there is still not much property development going on in the area. However, Ratchayothin is connected to both Phaholyothin and Ratchadapisek roads. That being said, it is slowly getting more popular among Bangkok northerners.

On top of the extension of the BTS line that leads to Ratchayothin station and continues further until the outskirts of Bangkok, we are going to see a lot more residential projects and mixed-use buildings in the future here.

Easy to remember with the station of its name, BTS Ratchayothin is a connected skytrain of Sukhumvit line. And just a few stops away is BTS Ha Yeak LadPrao station which you can switch to the MRT line. Or just a little bit further from that is BTS Mochit, a Bangkok northern hub of public transportation with BTS, MRT, Bus and Taxi station all at once.

The main road of Ratchayothin neighborhood is Phaholyothin road, which is aligned to Vibhavadi-Rangsit road. So you can be sure that you will easily travel both to or out of Bangkok city with this route. Also from Ratchayothin, you can take Ratchadapisek road along the MRT line to LadPrao district.

Since the extension of BTS Sukhumvit line to Khu-Khot station has been fully operated, it draws a lot of investment to the area for both residential and commercial projects including office buildings and high-rise condominiums. It is a route that has been in the development plan for many years.

In the future, we are definitely going to see a lot of upcoming residential projects for both low-rise and high-rise condominiums. Ratchayothin is surrounded by several landmarks of universities, schools and shopping malls with easy access to the skytrain line and major road. People consider this area a perfect neighborhood to live and settle.

Easy access of BTS Sukhumvit line along Ratchayothin area is definitely one of the reasons why the current price of this neighborhood has risen up over the years. The price on the market is now at 100,000 baht/sqm. (as of October 8th, 2022). It is expected that in the next 1-2 years, more condominiums and houses will be developed in response to the demand that constantly flows in the neighborhood.

The current rental price in Ratchayothin is starting at 8,000 baht/month. You can find many types of residentials from townhome to low-rise or high-rise condominiums for such an affordable price. Ratchayothin neighborhood is a perfect option for university students, locals, and office workers who want to avoid chaos in central Bangkok but still have access to public transportation.

Mazarine Ratchayothin offers more than convenience for their residents. Styled with a concept of an urban living-life with panoramic view of Bangkok skyline, this is definitely an ideal stay for those seeking convenience and comfort at the same time. Exclusively with a full option of facilities such as a party room and in-house bar, what else can you ask for?

The selling price starts at THB 4,790,000

Looking to rent at Mazarine Ratchayothin? click here

Looking to buy Mazarine Ratchayothin? click here

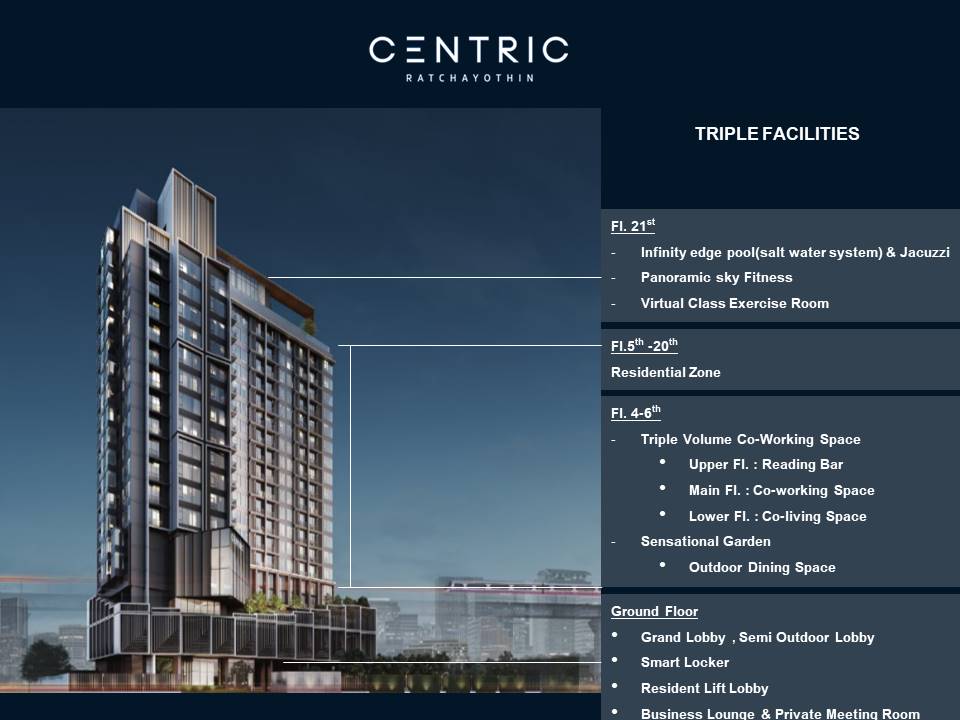

A place for your Hybrid Lifestyle is what Centric Ratchayothin commits to offer. A prime location next to BTS Ratchayothin with just a few minutes walk, full function facilities and surrounded by top locations; hospital, shopping malls and schools, Centric Ratchayothin is a one-of-a-kind residence in the neighborhood.

The selling price starts at THB 7,900,000

Looking to rent at Centric Ratchayothin? click here

Looking to buy Centric Ratchayothin? click here

A low-rise condominium in Soi Phaholyothin 37, a perfect living area for those seeking a peaceful and quiet neighborhood. Only 80 meters from Phaholyothin road and easy access to both MRT and BTS lines, and the current price is affordable.

The selling price starts at THB 3,500,000

Looking to rent at Bridge Phaholyothin 37? click here

Looking to buy Bridge Phaholyothin 37? click here

Ratchayothin is getting more attention throughout the years with the possibilities of upcoming residents, it is accessible on both BTS and MRT lines and connected to the main road of northern Bangkok. If you are looking for an affordable living resident, it’s time for you to make a move!

Looking for a property to buy or rent in Ratchayothin? Let PropertyScout help you!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise

Luxurious Bangkok life with the ultimate skyscraper

One of the biggest central business districts in Bangkok, Sathorn is definitely a prime location for every industry. Also, you might have already seen the iconic landmark of Sathorn, Chong Nonsi Skywalk, which appeared in so many movies. Needless to say, Sathorn is a great example of the best of both worlds. It is a hub of office workers but at the same time, a mixture of tourist destination and urban hangout spot. On top of that, the BTS and BRT skyline is easily accessible, just a few steps connected to MRT station.

There is no question that Sathorn is a top location and setting for offices. Everyday, you will see thousands of office workers roaming around, making the neighborhood a city that never sleeps. Being a major commercial district by day and party vendors of high-end rooftop bars by night, Sathorn is a one-of-a-kind area for those seeking a luxurious lifestyle.

Sathorn Road has been a main commute of the neighborhood, covering six districts and passing through Bangrak which made Sathorn a connection between Central Bangkok and the old town side of Thonburi. Along the road are many famous hotels and upscale condominiums.

Featured in so many famous movies and TV shows, both international and domestic, Chong Nonsi Skywalk is an exceptional landmark in the neighborhood, located just right by the sky train station. If you are working in this central business district, you have definitely walked pass the spot on any day.

A new Bangkok canal park recently opened for everyone to discover, this landmark aims to be a destination for both tourists and locals. There is no denial to add more green scenery to the neighborhood. It opens everyday from afternoon until late.

Offering an outdoor 360 degree panoramic view of Bangkok makes Mahanakorn Skywalk one of the Bangkok must-see bucket list. You will be 310 meters above the ground from the 78th floor, discovering an amazing view of Bangkok skyline.

Empire Tower is an ideal location for offices of all shapes and sizes. It is considered one of the largest office space rentals in Bangkok. Along with a few walks from BTS Chong Nonsi station, the definition of convenient can’t even be described!

With a long lasting history since 1888, The House of Sathorn is a historical landmark located in the center of the neighborhood, well known for Thai authentic restaurants, world-class dining, and wedding venues.

A Thai culinary treasure offers you both dining options and Thai cooking classes, along with decoration with such a priceless historical setting to welcome tourists worldwide. A prime location on Sathorn road, Blue Elephant Royal Thai Cuisine is available for private functions as well.

A brand-new Mexican restaurant located on the 76th floor of The Standard Mahanakorn Hotel. Not only does the restaurant offer such splendid tasteful dishes, but also a spectacular decoration with a view of Sathorn, making Ojo a go-to for Instagrammers to check-in!

Sathorn is a stop for BTS Chong Nonsi station, which is connected to BRT lines. Despite a walking distance to other neighborhoods such as Bangrak and Silom, there’s still many BTS stations along the road that you can take, for example Surasak and Saint Louis station.

Bangkok BRT, or bus rapid transit system, has its first stop starting from Sathorn to Ratchapruek station, which is located in Nonthaburi province, making this another option if anyone wants to commute outside of Bangkok from the central area.

Traveling within Sathorn with public transportation is easy, but with the car it is even simpler. Besides high traffic during rush hour, Sathorn road is an important getaway, since the road itself is connected to major areas in Bangkok, leading from Rama IV to Charoen Krung road. You can commute from the city-central to the old town side of Bangkok with just a short distance.

A home for high-end condominiums and skyscrapers, Sathorn has many upcoming landmarks such as luxury buildings and five-star hotels. 125 Sathorn is a new luxurious residential project with a value of 8,000 million baht, located on a prime Sathorn road frontage and aims to be a new landmark in the neighborhood. The price itself is likely to increase 2-3% every year and a great investment opportunity is being considered.

Grand Nikko Sathorn, set to open in 2025, will offer 405 facilities such as restaurants, rooftop bars, and many more, along with a top floor of panoramic Bangkok view. It is to be sure that the hotel is going to become a destination for the travelers, both business and leisure stays.

Located in central Bangkok, being a big name for a business district and also a home for high-end accommodation, the price on the market has risen up to 450,000-750,000 baht/sq. (as of September 29th, 2022), and will continue to grow with the expectation of upcoming landmarks in the form of hotels and luxury rental projects.

Current rental prices in the Sathorn area are starting from 10,000 baht/month for a studio room. However, with the prime location close to BTS station in walking distance, it could be really rare to find a room with the current price mentioned. The nearer to the important landmarks, the more expensive the rental price, but you can be sure to live closer with everything you need in the area!

Over 700 units makes Knightsbridge Prime Sathorn a top location to stay among residents. The condominium offers full facilities such as a swimming pool, 24-hour security, parking, and a garden. It is located on Narathiwas road, which is convenient to commute by both cars and public transportation.

The selling price starts at THB 3,800,000

Looking to rent at Knightsbridge Prime Sathorn? click here

Looking to buy Knightsbridge Prime Sathorn? click here

With the concept of the Art of Living in Bangkok, The Met Sathorn is located just a few minutes from BTS Chong Nonsi station. The condominium has various room types from 2 bedrooms to a penthouse. The building reaches to 66 floors, no doubt it offers a spectacular view of Sathorn road!

The selling price starts at THB 16,000,000

Looking to rent at The Met Sathorn? click here

Looking to buy The Met Sathorn? click here

Another prime location condominium, The Address Sathorn, is located on Sathorn Soi 12 with easy access to BTS Chong Nonsi and Surasak station and Silom road. The residence offers different types of room layouts from 1 to 3 bedrooms.

The selling price starts at THB 8,500,000

Looking to rent at The Address Sathorn? click here

Looking to buy The Address Sathorn? click here

Sathorn is an ideal combination of everything you need in a neighborhood, it can be a home for office workers who don't want to commute too far from their work lives, or a destination for tourists seeking to visit famous landmarks. Whatever you are looking for in the central district, Sathorn has all the answers!

Looking for a property to buy or rent in Sathorn? Let PropertyScout help you!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise

On Nut, a home for young professionals with everything in between

Fast growing area with the number of population increasing every year but still makes you feel livable despites just a short distance from major districts such as Thonglor and Ekamai. And within a few steps from upper Sukhumvit top up with affordable cost of living, On Nut is definitely a one-of-a-kind neighborhood.

On Nut has made it to the top list when one is looking for a resident in Sukhumvit, especially if they want to be a bit further away from a crowded living area with a lower price. And the expanding of BTS Sukhumvit line from Bearing and beyond, On Nut (or as most of the expat claimed southern Bangkok) is going to be a neighborhood for young professionals.

As you may know this already, On Nut is considered a BTS station with a high abundance of markets, shopping malls, vendor stores, and a lot of residents, which is the reason why it's always bustling with a lot of condominium markets continuing to grow.

Located on T77 Community Mall on Soi Sukhumvit 77, which is also known as On Nut road. Under the concept of ‘The Art of Good Living’, the mall aims to offer an urban and convenient lifestyle for every customer. Designed as semi-outdoor, Habito Mall is full of restaurants, co-working spaces, and grocery stores.

On Nut Market has been open for almost 38 years, and is considered one of the most local markets you will find in upper Sukhumvit. As of now, the market has created a new zone of On Nut Fresh Mart to attract more like-minded young individuals, as per their intended target customers.

Mahabut is not just a temple for Thais. The famous folk tale love story of Mae Nak has been with us for ages, and Mahabut temple is where it all started. We believe that whatever wish you ask for can come true if you ask for a blessing from Mae Nak shrines at the temple. If you have a chance to visit, you will see lots of people paying with gifts in the form of pretty clothes and dresses to the shrine.

If you are thinking of an All-you-can-eat buffet, Best Beef is probably one of the best places to visit. With an open-air dining experience and a variety of options on the menu such as beef, pork, and seafood, as well as the price being affordable. It is totally a place where you can gather friends to hang out and enjoy an abundance of food at the same time!

BTS Skytrain On Nut station is what you need when visiting the On Nut area. Just the first few steps from the station, you will find shopping malls, places to eat, and street food vendors. Also easily accessible to travel to the center, since Thonglor and Ekamai are only a few stops away.

Along the line of Sukhumvit road from lower Sukhumvit (or we also known as Wattana district), then take a turn at Soi Sukhumvit 77, you will find Soi On Nut. The street covered almost 12 kilometers from Pra Khanong to Pravet district.

On Nut is a homey neighborhood under a reasonable cost of living, busting with many restaurants and community malls that you can be sure are always under your budget. Also, since young professionals are looking for a place to stay further from the central busy business district, upper Sukhumvit has become their ideal options. We will definitely see the rise of upcoming residential projects such as high-end condominiums and townhomes in the near future.

As mentioned, the population in On Nut is increasing, which makes the area a strong potential for residential projects. The current price of this neighborhood is currently at 200,000 baht/sq. (as of 28 September 2022). On Nut BTS station used to be the end of the skytrain line. However, with the expanding of stations towards upper Sukhumvit to Samut Prakan provinces, this area is likely to become more popular and, of course, the price is definitely going to rise every year.

The current rental price in On Nut is starting at 8,000 baht/month, which is cheaper compared to other Sukhumvit areas. Most of the residentials projects are low-rise condominiums and townhomes.

Located on Sukhumvit 81 with only 30 meters from BTS On Nut station, this high-rise condominium has a total of 935 units with full options of facilities such as a swimming pool, fitness, garden, lobby, and 24-hour security.

The selling price starts at THB 2,490,000

Looking to rent at Ideo Mobi Sukhumvit 81? click here

Looking to buy Ideo Mobi Sukhumvit 81? click here

150 meters away from BTS On Nut station, you will have this high-rise condominium with a total of 28 floors. The building designed in L-shape aligns with the frontage of Sukhumvit road. The residents will definitely see the view of the busting Sukhumvit district all day and night.

The selling price starts at THB 4,000,000

Looking to rent at Q House Sukhumvit 79? click here

Looking to buy Q House Sukhumvit 79? click here

Under the concept of ‘Total Well-Being’ for everyone, The Base Sukhumvit 77 was made with a healthy lifestyle, including a gigantic garden facility for residents, along with futsal and basketball field. And a prime location is only 2 minutes away from On Nut road.

The selling price starts at THB 1,790,000

Looking to rent at The Base Sukhumvit 77? click here

Looking to buy The Base Sukhumvit 77? click here

If you are one of those who are looking for a place to stay not too far from Sukhumvit Road and also want to avoid chaos under a limited budget of accommodation, look no further! On Nut is definitely the answer you’re looking for!

Looking for a property to buy or rent in On Nut? Let PropertyScout help you!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise

The new Central Business District of Bangkok

Rama 9, also known as "Phra Ram 9" to some, offers one of the most desirable and eclectic lifestyles that Bangkok has to offer. Positioned as potentially the largest new city in Bangkok, it strikes a balance between business, lifestyle, and leisure. This area holds a prominent position as one of the top residential and property investment prospects in the capital. What makes this area interesting? Let's find out!

Rama 9 is a thriving neighborhood known for its blend of cultural traditions and contemporary developments. Gradually evolving into a bustling business ecosystem, it boasts significant commercial development, particularly notable for the presence of Chinese-owned establishments and the expansion of local and international business headquarters.

Rama 9 is a lively neighborhood, always bustling with excitement and activity. In the past, it was known as a renowned entertainment hub. In the year 2004, the underground train (MRT) began operating with a station named "Phra Ram 9", making transportation more convenient. This led to the area's increasing popularity and transformation into an economic hotspot, particularly along Ratchadaphisek Road.

Consequently, the area has become a gathering place for office workers. To accommodate the growing population, numerous condominium real estate projects were developed. Furthermore, the proximity of the Thai stock exchange and the presence of the Chinese Embassy near the MRT station have further contributed to the area's economic significance. Thus, Rama 9 has emerged as a thriving economic hub.

The Rama 9 area is renowned as a 'one-stop experience of nightlife' and boasts one of Bangkok's most popular attractions.

Royal City Avenue (RCA) provides the largest entertainment venue for experiencing Bangkok's vibrant nightlife.

This area is home to some of the best bars and clubs, including Route 66, Onyx, and Live RCA.

This area includes the Rama 9 Mall, with prominent examples such as Central Rama 9, Fortune Town (located in Rama 9), and Esplanade Ratchada, along with The Street Ratchada (located next to Thailand Cultural Center).

These locations offer an abundance of shops, restaurants, cafes, and fashion outlets, providing opportunities to dine, relax, and shop for clothing, fashion accessories, gadgets, home appliances, décor, books, as well as beauty salons and spas.

If you ever feel bored and crave something refreshing to rejuvenate your mind, we highly recommend a visit to Suan Luang Rama IX (Suanluang Rama 9), the largest public park in Bangkok. This lush oasis offers an extensive property adorned with picturesque pavilions, a sizable lake, and sprawling flower gardens, making it an ideal destination for those seeking tranquility amid nature. The park is particularly enchanting during the winter months, from late November to early December, when the weather is dry and cooler. Alternatively, feel free to visit at your convenience. Moreover, the park hosts local food markets, ensuring that you can savor delectable local delicacies whenever hunger strikes.

In the Rama 9 area, for those seeking specialized healthcare in Bangkok, Praram 9 Hospital, also known as "Rama 9 Hospital," is an excellent choice. It is a sizable 16-story medical facility spanning over six acres. The hospital is committed to becoming the most trusted healthcare provider, aiming to deliver valuable, high-quality, and dependable medical services in line with international standards akin to leading healthcare institutions worldwide.

The Rama 9 area is accessible via a road spanning approximately 9 kilometers, starting at the Rama 9 intersection of Ratchadaphisek Road and Asoke-Din Daeng Road. Continuing east, it intersects with Pradit Manutham Road and Ramkhamhaeng Road in the Bang Kapi area. Ultimately, the road leads to the Srinakarin Road intersection, linking up with the motorway, creating a seamless car route.

To bypass the traffic congestion, you can conveniently reach the malls in the Rama 9 area via the MRT station named "Phra Ram 9 station" or "Rama 9 MRT." This station facilitates easy access to Fortune Town and G-Land developments located near the road junction of the same name, where Din Daeng, Asok-Din Daeng, Ratchadaphisek, and Rama IX roads converge.

Learn More:

The Rama 9 area is witnessing a surge in real estate developments, particularly in the form of numerous condominiums that continue to dominate the landscape. Notably, the introduction of a mixed-use project by the Central group is expected to establish the area as the new business center, thereby piquing the interest of potential investors. Consequently, it is anticipated that various developments will unfold within a short period, contributing to a significant annual escalation in the area's property prices.

Presently, the land prices in the Rama 9 area have escalated to 200,000 – 300,000 THB per square meter (Information sourced from the Treasury Department).

Rise, a condo project developed by Rise Estate Co., Ltd., presents 8 floors of units, featuring 1 to 2-bedroom options. Conveniently situated in Bang Kapi, Huai Khwang, this condominium offers comprehensive facilities, including CCTV, security, a garden, parking, and a swimming pool.

The selling price starts from 2,400,000 THB, with rental options available from 10,000 THB per month.

Aspire Rama 9, a condo project developed by AP (Thailand) Public Company Limited and completed in 2014, stands as a high-rise condominium spanning 23 floors and comprising a total of 663 units. The units range from 1-bedroom to 2-bedroom layouts. Located in the Huai Khwang area, it enjoys close proximity to the MRT Phra Ram 9 public transport stations. Aspire Rama 9 offers a comprehensive range of facilities, including fitness amenities, a garden, parking, security, and a swimming pool.

The selling price starts from 2,500,000 THB, while the rental option begins at 12,000 THB per month.

Ideo Mobi Rama 9, a condominium project developed by Ananda Development, was completed in 2014. The condominium consists of a single 28-story building, encompassing a total of 705 units. It is situated on Thanon Rama IX, Huai Khwang.

The selling price begins from 3,000,000 THB, while the rental option starts at 13,000 THB per month.

The Rama 9 area presents an intriguing prospect, poised to evolve into the premier new Central Business District (CBD) in Bangkok. With a wealth of available facilities and ongoing rapid development, this area offers promising real estate opportunities for long-term stay and investment. Its continual advancement is expected to elevate the zone's potential, solidifying Rama 9 as an enticing location capable of attracting investors.

Looking for a property to rent or buy in Rama9? Get in touch with us at PropertyScout today!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Free real estate resources and tips on how to capitalise